Now, more than ever, you will need the guidance of our licenced Finance Brokers to assist with the review and assessment of your lending options prior to the commencement of your searching for your next intended home or investment property.

Some of the key issues are summarised below:

Servicing

Banks have tightened the methodology of how they calculate your servicing capacity which can significantly affect the amount of loan you would now qualify for.

These rules are especially harsh on investors and offshore owners.

As such, you cannot assume that you may automatically qualify for 80% lending as even though you may have the required deposit, the servicing calculations may impact the level of approval and reduce the loan amount.

If you commit to a property without a “subject to finance” then you may be placing your deposit at risk should lending not be as much as you had required.

At SMATS we strongly recommend that you seek out a lending assessment or pre-approval with our finance team prior to commencing your search. This will allow you to be fully aware of your options and act with knowledge and protection to make a safe and sensible acquisition.

Equity release loans

If you have been able to build equity in your property through value appreciation or debt repayment, this has traditionally been relatively accessible for further investment.

It has become increasingly difficult, but not impossible, to arrange these loans, with banks being more diligent on the use of funds to protect their lending position.

If you are considering accessing some equity for further investment, next property acquisition, refinance of personal debt or lifestyle expenses, then contact our team to discuss your options.

Interest rates

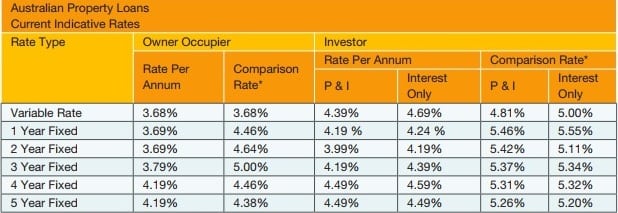

Although the Reserve Bank of Australia has not changed the official rate since August 2016, the Australian banks have been increasing the investor loan rates on their own accounts. Owner occupier rates have remained largely unchanged and still at record low levels.

In addition, loans where the repayments are only for interest are now being charged a higher rate than loans that are reducing the principal as well.

Some banks have also taken it upon themselves to charge a premium on overseas based borrowers, although this often does not apply if the client is an Australian citizen or holds a permanent resident visa. If you think you may have been wrongly charged for this it is important that you contact the bank as soon as possible to rectify this or contact us to confirm your arrangements.

The current indicative lending rates are detailed below for your reference. Feel free to contact us should you have any queries in regard to your personal lending requirements.

* The comparison rate is based on a loan of $150,000 over a 25 year term. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

_______________________________________________________

By Helen Avis: SMATS Group and Specialist Mortgage Director (Australian Credit License 385201)

SMATS GROUP: Australian Property, Tax & Finance Experts since 1995.

Trust SMATS Group for all your Australian taxation, finance and property advice. Visit SMATS.net, email smats@smats.net or phone (UK) +44 207 5383914

_______________________________________________________

TOP IMAGE: Nattanan23 via Pixabay